Commodities - Energy

Crude Oil May Become Rangebound

Crude Oil (WTI) $77.39 -$0.43 -0.55%

Despite a late day stock market reversal on Monday, crude oil was able to eke out yet another gain. Prices have now risen in five of the last six sessions. The bottom line right now is that crude oil has bottomed out and traders will be looking to buy dips rather than sell rallies. The move from $87 to the mid-$60’s was largely a function of fear that the world economy would experience substantial slow down, with major economies potentially falling into a second recession, a double dip. At least so far, these bearish fears have not come to fruition, thus prices naturally rise as selling pressure exhausts itself. That said, crude inventories remain high and as long as budgets are being cut across Europe, risks remain, and so a rally significantly above $80 seems unlikely. A range trade may be the scenario that is developing here. Look for support at $75.50 and resistance at $80.00.

Despite a late day stock market reversal on Monday, crude oil was able to eke out yet another gain. Prices have now risen in five of the last six sessions. The bottom line right now is that crude oil has bottomed out and traders will be looking to buy dips rather than sell rallies. The move from $87 to the mid-$60’s was largely a function of fear that the world economy would experience substantial slow down, with major economies potentially falling into a second recession, a double dip. At least so far, these bearish fears have not come to fruition, thus prices naturally rise as selling pressure exhausts itself. That said, crude inventories remain high and as long as budgets are being cut across Europe, risks remain, and so a rally significantly above $80 seems unlikely. A range trade may be the scenario that is developing here. Look for support at $75.50 and resistance at $80.00.

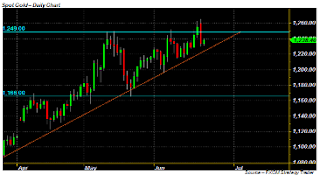

Gold Has Potential Key Reversal

Gold $1238.40 +$4.70 +0.38%

After hitting new all-time highs above $1265 on Monday, gold got pounded in what some are calling a key reversal. Prices are currently rebounding some of those losses. As discussed at length previously, gold’s rally is a function of investment flows, primarily investment flows into ETFs. Because of the nature of the rise—one that is investment driven—there is little way to predict gold’s near-term direction. Instead, the best course of action for those that want to be involved is to buy the dips with tight stops. Indeed, gold’s relatively low volatility is conducive for such trades, but as Monday’s action demonstrated, large daily moves are still very much possible.

Silver $18.83 +$0.10 +0.55%

Silver is recovering a bit, after following gold lower in the prior session. At this point, silver is a leveraged play on the precious metal theme. From a technical standpoint, silver is still very much in a bullish formation. Prices got close to May highs near $19.83 on Monday, but are now substantially below those levels. Assuming gold does not fall apart in the coming days, look for silver prices to make their way back toward those levels. A break of those May highs exposes the 2008 highs near $21.36.

No comments:

Post a Comment